Applying for an Employer Identification Number (EIN) directly from the IRS is free and takes only minutes. Simply answer the questions and submit your application. If approved, your EIN is issued immediately online.

Beware of websites that charge for EIN application. You should never pay a fee for this service.

EIN registration is mandatory for most businesses in the United States. This number is used to identify your business for tax purposes. The EIN application process is straightforward and can be completed online through the IRS website.

Having an EIN allows your business to operate legally and comply with tax regulations. This is crucial for the sustainable growth of your business.

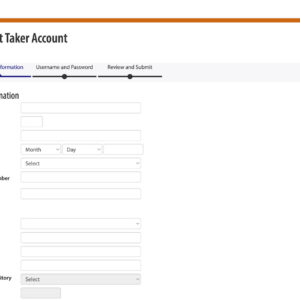

To be eligible to apply for an EIN, your business must be located in the United States or U.S. territories. You also need to be the principal officer, general partner, grantor, owner, or authorized representative and have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

You must complete the application in one session, as you cannot save and return later. Your session will timeout after 15 minutes of inactivity, and you will need to start over. After completion, print your EIN confirmation letter for your records.

Requirements for using the online EIN application service include: principal business located in the U.S. or U.S. territories; you are the responsible party or an authorized representative; and possessing the responsible party’s SSN or ITIN.

You cannot use the online EIN application tool if your principal business is located outside the United States. In this case, you need to apply by phone, fax, or mail. Additionally, only government agencies are permitted to apply for an EIN using an existing EIN.

Gather the necessary information before starting the EIN application process to ensure quick and accurate completion.

You can get an EIN directly from the IRS in minutes. Visit the IRS website to begin the application process today.

The online EIN application tool operates Monday through Friday, 7 a.m. to 10 p.m. Eastern Time.

Each responsible party can only apply for one EIN per day.

Before applying for an EIN, you should form your legal entity (LLC, partnership, corporation or non-profit organization) through your state. Failure to do so may delay your EIN application.

Businesses, corporations, and certain trusts need EINs to manage taxes. You generally need an EIN to hire employees, operate a partnership or corporation, file excise or employment tax returns, change business structure or ownership, and operate certain trusts, retirement plans and estates.

After receiving your EIN, you must file any required tax or information returns. If you already have an EIN, consider when you need to apply for a new one.

If you are unable to apply online, learn how to apply by phone, fax, or mail.

You may have to report certain beneficial owner information to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury. Certain corporations, limited liability companies, and other similar entities created in or registered to do business in the United States must report information about their beneficial owners—those who ultimately own or control the company—to FinCEN beginning January 1, 2024.

If you are a reporting company, the initial beneficial ownership information report is due based on the date your company received actual notice that the company’s creation or registration was effective, or after the secretary of state or similar office first publicly discloses the company’s creation or registration, whichever is earlier.

Questions such as whether my company must report beneficial ownership information to FinCEN, who is a beneficial owner, and when must I report my company’s beneficial ownership information are found on FinCEN’s website. The FinCEN website provides detailed information about beneficial ownership.

Contact FinCEN for more information and questions. The IRS cannot answer FinCEN questions.