To effectively manage cashback, it’s crucial to separate it from sales revenue. This ensures cashback isn’t counted as income and accurately reflects cash flow. Think of it as a transfer from the till to the merchant account.

Let’s say:

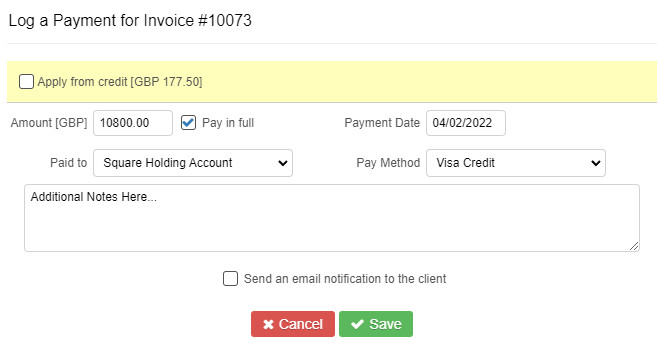

- Daily sales: £9,000 + VAT (£10,800)

- Total daily cashback requests: £200

- Starting till: £500, with £200 designated for cashback.

Sales invoices are generated as usual.

Assuming all payments are by card, funds go directly to the merchant account (e.g., Square).

After processing sales, address the cashback. Your merchant account now holds the sales income. Add the cashback amount.

This creates an untagged entry. Tag it as a transfer from the till.

This increases the merchant account balance by £200 and decreases the till by the same amount, leaving £300 in the till.

Card processing fees are treated like any other expense.

In summary, there are two transactions: a bank transfer (the payment) and a transaction for the processing fee.

Assuming a £50 fee, a balance of £10,950 is transferred to the bank account.

The fee is tagged to a purchase invoice. The final transfer is tagged as a bank transfer and should reconcile with the bank statement. This is just one method; simpler approaches may exist. Consult your bookkeeper or accountant for specific advice.